Coface Asia Corporate Payment Survey 2024: Overall improvement but worsening payment behaviour in textile and

Economic Expectations: Growing optimism despite demand risks--

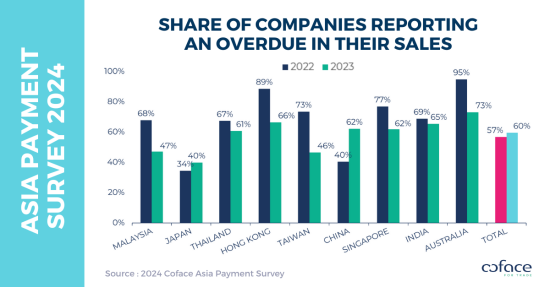

Textile and Construction saw a significant increase in late payments reported. Textile faced higher production costs and rampant demand, and Construction suffered sluggish China property sector and a high interest rates environment in most markets.

While the average payment delay duration dropped from 67 days in 2022 to 65 days in 2023, most markets covered saw a rise. Australia, Hong Kong and Malaysia saw the highest increase, while only China, Taiwan and Thailand saw a decline. Japan had the shortest average payment delay at 50 days, and Australia had the highest at 83 days.

The duration of payment delays increased the most in the textile and agri-food sectors, both by 11 days. Energy and pharmaceuticals saw the biggest falls, of 11 and 10 days respectively. The construction sector still has the longest payment delay (76 days), and the pharmaceutical has become the one with the shortest (57 days).

The proportion of respondents experiencing ultra-long payment delays (ULPD) over 2% of their annual sales has risen from 26% in 2022 to 29% in 2023. This 2% threshold represents a very high risk of non-payment, given that 80% of these delays have never been paid, according to Coface's experience. Singapore, Thailand, and Hong Kong lead the increase in the proportion of ULPDs. Textile is the sector with the highest share of respondents reporting ULPDs, with an increase from 14% in 2022 to 40% in 2023, while Construction and Metals both stand at a substantial 35%.

BACA JUGA:Mitsubishi Pajero Sport 2024 SUV Handa dan Mewah Berteknologi Tinggi dan Sistem Otomatis Model TerbaruCompanies are generally optimistic about future payment behaviours, with 30% expecting improvement in late payment trends while the 18% expecting deterioration are mainly textile and retail companies.

Economic Expectations: Growing optimism despite demand risks

Sumber: